Forex Trading for Beginners: A Comprehensive Video Guide

In the world of finance, forex trading has gained immense popularity, especially among those looking to venture into the opportunities of currency markets. As a beginner, understanding the core concepts and strategies of forex trading can be daunting. Fortunately, there are numerous resources available, including informative forex trading for beginners video https://www.minereum.com/ that can simplify the learning process. This article serves as a guide for beginners explaining the fundamentals of forex trading.

Understanding Forex Trading

Forex (foreign exchange) trading involves buying and selling currencies in pairs, with the aim of making a profit from fluctuations in exchange rates. Unlike traditional stock markets, the forex market operates 24 hours a day, making it accessible to traders worldwide. The largest and most liquid market, forex offers vast opportunities for both professional and retail traders.

The Basics of Currency Pairs

In forex trading, currency pairs are used to express the value of one currency relative to another. The first currency in the pair is the base currency, while the second is the quote currency. For example, in the currency pair EUR/USD, the Euro is the base currency and the US Dollar is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Types of Currency Pairs

There are three main types of currency pairs:

- Major Pairs: These involve the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: These currency pairs do not involve the US Dollar, like EUR/GBP and AUD/NZD.

- Exotic Pairs: These consist of a major currency paired with a currency from an emerging market, such as USD/TRY (Turkish Lira) or USD/HUF (Hungarian Forint).

Technical and Fundamental Analysis

To succeed in forex trading, beginners must familiarize themselves with two essential types of analysis: technical and fundamental.

Technical Analysis

Technical analysis involves analyzing past price movements and using chart patterns to predict future price trends. Traders often rely on various tools and indicators, such as moving averages, Fibonacci retracements, and Relative Strength Index (RSI), to make informed trading decisions.

Fundamental Analysis

Fundamental analysis focuses on the economic factors that impact currency values. Events such as interest rate changes, employment data, and geopolitical developments can significantly influence exchange rates. By staying updated on economic news and events, traders can anticipate market movements.

Choosing a Trading Strategy

Developing a solid trading strategy is vital for those starting their forex trading journey. Here are a few common strategies to consider:

- Scalping: This strategy involves making numerous trades within a single day to capitalize on small price movements.

- Day Trading: Similar to scalping, day traders buy and sell assets within the same trading day, avoiding overnight risks.

- Swing Trading: Swing traders hold onto their positions for several days or weeks, aiming to profit from medium-term price movements.

- Position Trading: This long-term strategy involves holding positions for weeks, months, or even years, based on fundamental analysis.

Risk Management in Forex Trading

Managing risk is crucial for success in forex trading. Effective risk management practices can help protect your capital and ensure long-term viability as a trader. Some key principles include:

- Always use stop-loss orders to limit potential losses.

- Never risk more than 1-2% of your trading capital on a single trade.

- Diversify your portfolio to reduce overall risk exposure.

- Stay disciplined and avoid emotional trading decisions.

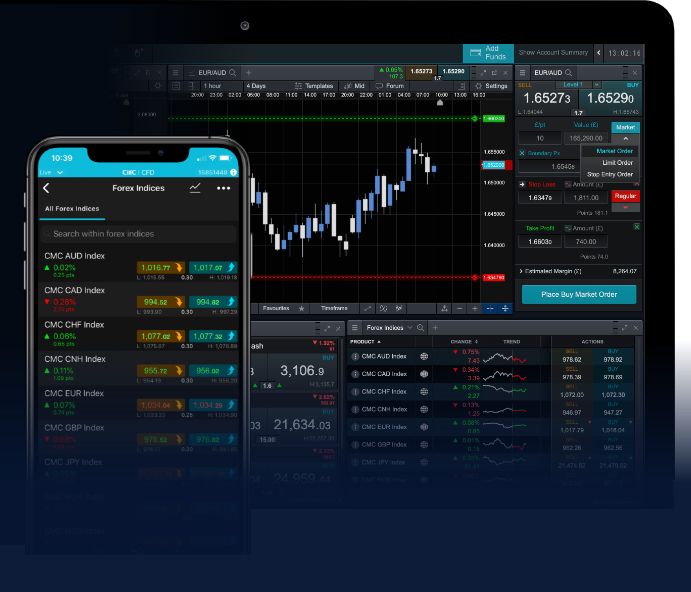

Utilizing Trading Platforms and Tools

To get started with forex trading, it’s essential to choose a reliable trading platform. Many platforms offer demo accounts that allow beginners to practice their skills without risking real money. Some popular trading platforms include MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide various trading tools, charting capabilities, and analysis features to enhance the trading experience.

The Role of Forex Brokers

Choosing the right forex broker is a critical step for beginners. Brokers act as intermediaries between traders and the forex market, and they provide the necessary trading infrastructure. When selecting a broker, consider factors such as regulation, trading fees, customer support, and the variety of trading instruments available.

Learning Resources for Beginners

While videos offer valuable insights into forex trading, there are various other resources available to help beginners enhance their knowledge:

- Books: There are countless books on forex trading that cover everything from basic concepts to advanced strategies.

- Online Courses: Many platforms offer structured courses designed to teach traders the ins and outs of forex trading.

- Webinars and Live Trading Sessions: Participating in webinars allows traders to learn from experienced professionals in real-time.

- Trading Communities: Engaging with other traders through forums and social media can provide valuable tips and insights.

Conclusion

Forex trading for beginners may seem overwhelming, but with dedication and the right resources, anyone can learn to navigate the currency markets. Whether you choose to watch informative videos or explore other learning tools, always remember to practice patience, develop a solid trading strategy, and manage your risks effectively. As you embark on your trading journey, success in forex trading can lead to rewarding financial opportunities.